Featured

Table of Contents

Thankfully, you do not have to take care of the search by yourself. At Taxfyle, we link people and local business with accredited, experienced CPAs or EAs in the US. We deal with the difficult component of discovering the ideal tax obligation professional by matching you with a Pro who has the appropriate experience to satisfy your unique requirements and will deal with declaring tax obligations for you.Get began with Taxfyle today, and see just how declaring taxes can be simplified.

While you can bargain with financial institutions by yourself, it's typically a complex and lengthy procedure, especially if you need to solve a big amount of financial obligation throughout several accounts. The procedure needs a solid understanding of your funds and the financial institution's terms in addition to self-confidence and persistence. Because of this, there are debt relief companies additionally understood as financial debt negotiation business that can manage the negotiations for you.

People that enroll in the red alleviation programs have, on standard, approximately $28,000 of unsafe financial debt throughout almost 7 accounts, according to an analysis commissioned by the American Association for Financial Obligation Resolution, which took a look at clients of 10 major financial obligation relief firms in between 2011 and 2020. Concerning three-quarters of those customers contended the very least one financial debt account efficiently resolved, with the regular enrollee clearing up 3.8 accounts and more than fifty percent of their enlisted debt.

Some Ideas on Calculating What You'll Pay for Mortgage Help for Low-Income Families: What Options Do You Really Have? : APFSC You Should Know

It prevails for your credit history to drop when you first begin the financial obligation alleviation procedure, particularly if you quit making payments to your lenders. As each financial obligation is worked out, your credit history need to begin to rebound. Make certain you comprehend the complete costs and the result on your credit scores when evaluating if debt negotiation is the right choice.

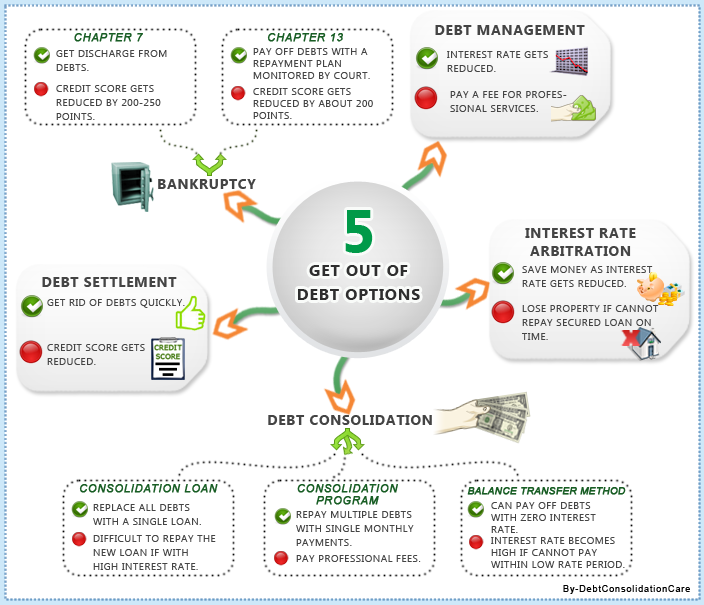

As stated over, there are alternatives to financial obligation settlement that might be a much better fit for your monetary scenario. This technique transforms numerous debts right into a single month-to-month settlement and usually uses a lower passion rate, simplifying your funds and potentially saving you money over time.

The Greatest Guide To Steps to Take Following Bankruptcy

Right here's exactly how each one works: Financial obligation loan consolidation finances: These are individual car loans that you can utilize to resolve your existing financial debts, leaving you with just one month-to-month bill, usually at a reduced rate of interest. Equilibrium transfer bank card: This entails moving your existing charge card equilibriums to a brand-new bank card that provides a reduced rate of interest or an advertising 0% APR for a set duration.

Once the period ends, rate of interest will be substantially high usually over 20%. Home equity car loans or HELOCs (home equity lines of credit): These lendings permit you to obtain versus the equity in your house. You obtain a round figure or a line of debt that can be utilized to repay financial obligations, and you commonly take advantage of reduced rates of interest compared to unsafe finances.

These plans have a number of advantages, such as simplifying your settlements by consolidating multiple into one and possibly lowering your rates of interest. They typically come with an arrangement cost ranging from $30 to $50, and a monthly upkeep charge of around $20 to $75, depending on the firm you function with.

Whichever your scenario is, take into consideration talking with a certified credit scores therapist, a bankruptcy attorney, or a qualified debt consultant before moving forward. They can help you obtain a full understanding of your financial resources and choices so you're better prepared to choose. Another element that influences your options is the sort of debt you have.

About Forms of Mortgage Help for Low-Income Families: What Options Do You Really Have? : APFSC You May Know About

Kevin Briggs was a successful property manager with a six-figure revenue, yet after a year of pandemic obstacles, he found himself in 2021 with $45,000 in charge card debt."I owed money way over my head," Briggs stated. "It seemed like I will lose every little thing. Then I obtained rescued."Much less than 3 years later, Briggs had removed his debt card financial debt, many thanks to that rescue a new nonprofit debt alleviation program from InCharge Debt Solutions called "Charge card Financial Debt Forgiveness."Charge Card Debt Forgiveness, also recognized as the Less Than Complete Equilibrium program, is financial obligation relief for individuals who have actually not been able to make charge card payments for six months and creditors have actually charged off their accounts, or will.

The catch is that not-for-profit Credit Card Financial debt Forgiveness isn't for everyone. InCharge Debt Solutions is one of them.

Restoring Your Financial Standing Following Mortgage Help for Low-Income Families: What Options Do You Really Have? : APFSC for Dummies

The Credit Score Card Forgiveness Program is for individuals who are so much behind on credit history card settlements that they are in serious financial difficulty, potentially facing personal bankruptcy, and don't have the earnings to capture up."The program is specifically made to aid clients whose accounts have been billed off," Mostafa Imakhchachen, consumer treatment professional at InCharge Debt Solutions, said.

Financial institutions who participate have actually agreed with the not-for-profit credit score therapy agency to accept 50%-60% of what is owed in taken care of month-to-month repayments over 36 months. The set repayments imply you understand precisely how much you'll pay over the payment period. No rate of interest is charged on the balances during the payoff duration, so the repayments and amount owed don't transform.

Table of Contents

Latest Posts

The Best Guide To Your Legal Protections According to State Law

Actions You Can Take to Recover Your Credit Fundamentals Explained

Our National Initiatives That Offer How Bankruptcy Counseling Helps You Avoid Future Garnishments and Judgments PDFs

More

Latest Posts

The Best Guide To Your Legal Protections According to State Law

Actions You Can Take to Recover Your Credit Fundamentals Explained

Our National Initiatives That Offer How Bankruptcy Counseling Helps You Avoid Future Garnishments and Judgments PDFs